WILL

A will is a legal document that sets out how your property will be distributed upon death. If you die without a valid will in place your property will be distributed in accordance with the relevant succession law in each state. This can create uncertainty and lead to family provision claims being brought by potential beneficiaries.

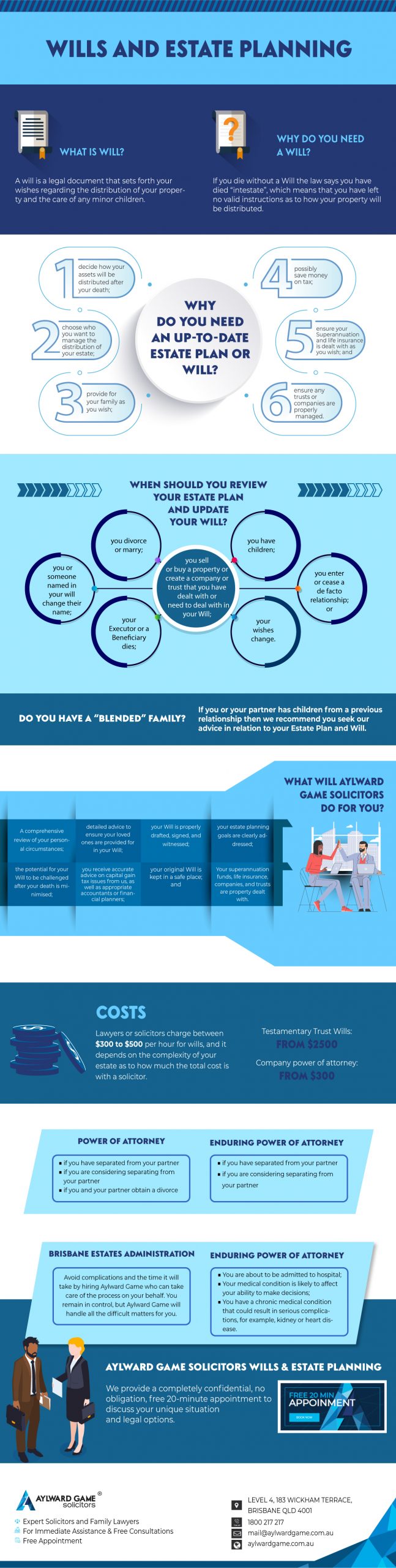

Why do you need a Will?

If you die without a Will the law says you have died “intestate”, which means that you have left no valid instructions as to how your property will be distributed. Your estate will then be divided up according to a formula in the legislation.

Why do you need an up-to-date Estate plan or Will?

An up-to-date Estate Plan or Will allows you to:-

■ Decide how your assets will be distributed after your death;

■ Choose who you want to manage the distribution of your estate;

■ Provide for your family as you wish;

■ Possibly save money on tax;

■ Ensure your Superannuation and life insurance is dealt with as you wish; and

■ Ensure any trusts or companies are properly managed.

When should you review your Estate Plan and update your Will?

Your Estate Plan and/or Will should be reviewed every 2 (two) years at least or upon any of the following circumstances changing:-

■ You divorce or marry;

■ You have children;

■ You or someone named in your will change their name;

■ Your Executor or a Beneficiary dies;

■ You sell or buy a property or create a company or trust that you have dealt with or need to deal with in your Will;

■ You enter or cease a de facto relationship; or

■ Your wishes change.

Do you have a “Blended” family?

If you or your partner has children from a previous relationship then we recommend you seek our advice in relation to your Estate Plan and Will. Wills for blended families can be more complex as the testator usually wants to provide for both their children and their current spouse, which can require particularly careful planning.

What will Aylward Game Solicitors do for you?

We will take care of the process for you, including:-

■ A comprehensive review of your personal circumstances;

■ Detailed advice to ensure your loved ones are provided for in your Will;

■ Your Will is properly drafted, signed, and witnessed;

■ Your estate planning goals are clearly addressed;

■ The potential for your Will to be challenged after your death is minimised;

■ You receive accurate advice on capital gain tax issues from us, as well as appropriate accountants or financial planners;

■ Your original Will is kept in a safe place; and

■ Your superannuation funds, life insurance, companies, and trusts are property dealt with.

Costs

The cost involved in an estate plan review and the preparation of a Will depends on individual circumstances and how complex the Will needs to be in order to effectively deal with your individual circumstances. The Will is only one element of a broader process.

We do however offer very reasonable fees for an estate plan review and Will preparation.

When you consider the peace of mind you will have in knowing everything is in order in the event of your death; the cost of drafting your Will is not an expensive outlay.

An Estate Plan and a Will are some of the most important documents you will make in your lifetime and without professional advice, you could unintentionally leave your family with very complicated, difficult, and expensive issues to resolve.

POWER OF ATTORNEY

A Power of Attorney is a legal document that authorizes another person to conduct financial affairs on your behalf, for example, buying or selling land. If you appointed your spouse to act as your attorney for financial matters it is important to consider reviewing your Power of Attorney if one of the following circumstances is applicable to you:

■ If you have separated from your partner

■ If you are considering separating from your partner

■ If you and your partner obtain a divorce

ENDURING POWER OF ATTORNEY

An Enduring Power of Attorney is a legal document that authorises another person to make financial and health decisions on your behalf.

Your attorney will be able to continue making financial and health decisions in the event that you lose the capacity to make those decisions on your own behalf.

If you appointed your spouse to act as your attorney it is important to consider reviewing your Enduring Power of Attorney if one of the following circumstances is applicable to you:

■ If you have separated from your partner

■ If you are considering separating from your partner

BRISBANE ESTATES ADMINISTRATION

When you are faced with the work of administering an estate as the executor, you may keep away stress, avoid complications and the time it will take by hiring Aylward Game who can take care of the process on your behalf. You remain in control, but Aylward Game will handle all the difficult matters for you.

If there is no will we are able to advise and assist you in relation to the intestacy rules and if necessary we can prepare and submit the application to the Supreme Court of Queensland for the grant of letters of administration.

We will prepare the application to the Supreme Court of Queensland for the grant of probate when one is needed and help you concerning intestacy rules if and when needed. We may prepare plus submit your application to the Supreme Court of Queensland for grant of letters of administration.

ADVANCED HEALTH DIRECTIVE

An Advanced Health Directive is a document that states your wishes or directions regarding your future health care for various medical conditions. It comes into effect only if you are unable to make your own decisions.

You can make an Advanced Health Directive if you are over the age of 18 and have the capacity to do so. You can make an Advanced Health Directive at any time, however, it may be particularly important to consider one if:

■ You are about to be admitted to hospital;

■ Your medical condition is likely to affect your ability to make decisions;

■ You have a chronic medical condition that could result in serious complications, for example, kidney or heart disease.

It is important to discuss this with your doctor, as part of the Advance Health Directive Form must be completed by a doctor. It is also important to discuss your wishes with your family.

You can change or revoke your Advance Health Directive at any time, provided you still have the decision-making capacity to do so. It is recommended that you review your directive every two years, or if your health changes significantly.

Article Source: Wills And Estate Planning